Why SAP’s Magic Quadrant Placement Misses the Full Picture

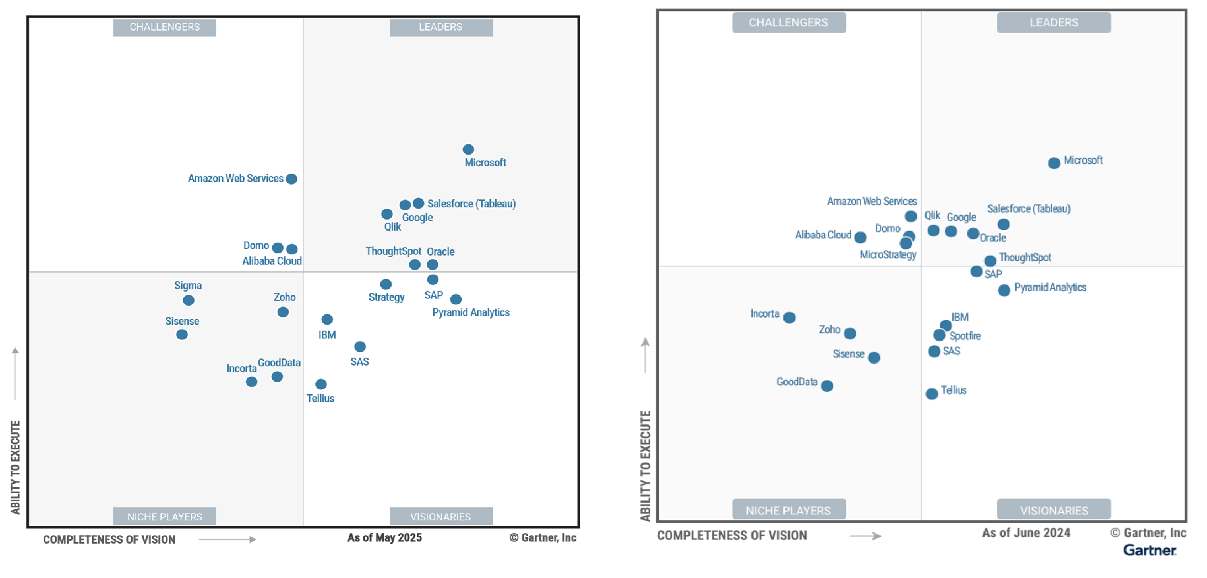

Gartner released its Gartner Magic Quadrant for Analytics and Business Intelligence (ABI) Platform a few days ago. This report is the most important talking point for leaders and gives a quick summary of all the Analytics and BI platforms that are available to the market. In this blog post, I will go over the trends in the market that Gartner is seeing and do a deep-dive on the outcome for SAP.

Why Gartner’s Definition Under-counts Best-of-Breed Stacks

What is interesting about the ABI Platform report is the definition that Gartner uses to come to a report on ABI Platforms. There are quite a few mandatory features that are needed in the total platform to be evaluated as one of the 20 vendors in the report. Summarizing the list of mandatory features basically results in an "end-to-end" platform need. Basically you have to have a data warehouse and a visualization solution as a vendor, to be measured in this report. This approach is interesting (and maybe a bit classical) as we see more and more hybrid platforms where different vendors are in play in the real world nowadays. Databricks for example is not part of this report (although it is a honourable mention) since it is currently still lacking visualization capabilities, while I do see it being used more and more as one of the core components in an Analytics and BI Platform at bigger customers.

With that in mind let's take a look at the outcome of the quadrant.

Why the ‘Visionaries’ Shift May Be Premature

Firstly: when comparing this year's Magic Quadrant to last year's the total shift to the right (more visionary) is something that draws attention.

According to Gartner the shift is due to emergence of GenAI, agentic workflows and "end-to-end" automation, which re-defines what it means to have "completeness of vision". In reality we hardly see any added benefit at the moment of AI in the current state of the BI platforms, so this shift of visionaries seems to come a bit early.

Based on the definition that Gartner is using to rank the different vendors it is logical that Microsoft comes out on top of everything. They have everything in-house to serve all the criteria for the report, even though the choices when using Microsoft BI tooling are often not that straight forward. Microsoft Fabric seems to be treated as a definitive product in the report, but in reality Fabric still feels more like a bundle of products under the same name, often resulting in confusing architectures when used (i.e. data processing can be handled in multiple tools). Especially when valuing AI as a key-factor, Microsoft has a nice asset with Co-Pilot, helping them get that "top" spot.

Why SAP’s Vision Gets Short-changed

The SAP section in the Gartner report is confusing for anyone working day-to-day with SAP's Business Intelligence tools. The report heavily emphasizes SAP Analytics Cloud while giving only passing mention to SAP Datasphere and SAP BW, treating them as separate from the core Analytics and BI Platform. This approach seems inconsistent when compared to Microsoft's coverage, where Power BI's integration within the broader Fabric data and analytics stack is highlighted as a key strength.

So the key strengths coming from the report are:

- Strong Platform Administration

- Strong integration and reduced total cost of ownership (TCO)

- Tailored industry applications.

It is a good thing that the integration of SAP Analytics Cloud with SAP Datasphere and eventually SAP enterprise applications (S/4 HANA, Succesfactors, etc.) was seen as a strength in the 2024 report and this has been something that heavily improved since then. This is recognized by Gartner in this years' report, which is a good thing. Live queries from SAP Analytics Cloud on SAP data sources without moving data and preserving data authorizations are seen as one of the major strengths of the product, but in my opinion SAP Datasphere is vital in that part to be able to achieve this. Running live queries from SAP Analytics Cloud to a SAP enterprise application is a nice to have, but will often not suffice the business requirements. This is where SAP Datasphere will add major value. It is these minor details that are lacking in the report in my perspective, to get a full understanding of the product and to be able to really compare different vendors.

When looking at the cautions the heavy focus on SAP Business Data Cloud (BDC) makes the "Limited Cloud Options", a bit to heavy in my opinion. Yes, BDC is currently only available through Amazon AWS, but I have seen SAP Datasphere being hosted on Microsoft and Google as well, so there is no doubt that that will become available sooner than later.

The low moment outside of SAP ecosystem is something that I have obviously seen quite a few times, and the point makes sense. SAP BI tooling has traditionally been used more in companies that run SAP, it is quite a leap to use it when there is no SAP enterprise applications involved in the company.

Finally Gartner sees a lack of functional differentiation for SAP Analytics Cloud. This is probably true when you see SAC just as a visualization tool on top of SAP enterprise applications (with or without SAP Datasphere), but I think SAC shines on the integration of Planning data, especially when seamless planning is in place.

3 Steps to Turn MQ Insights into Your Best Decision

While reading the Gartner report the thing I struggle with the most is how to value the outcome of the quadrant. Having in-depth knowledge of a few of the vendors that are in the report, really shows that this report is far from detailed or complete enough to really value any of the findings. I would advise you to follow the following three-steps when using the Magic Quadrant:

- Filter the MQ against your must-have checklist (live-query, planning integration, hybrid support).

- Pilot 3–5 finalists with time-boxed POCs on your own data.

- Score each vendor on real metrics: TCO, time-savings, admin overhead, "end-to-end" user adoption.

You can find the full report here.